south dakota property tax due dates

ViewPay Property Taxes Online. Real Estate Mobile Home and Special Assessments.

Composition Of State And Local Tax Rev Income Tax Government Taxes Revenue

M-F 830-500 No transactions will begin after 440 pm.

. 1st Floor Courthouse Office Hours. Real Estate Taxes in South Dakota are due twice a year the first half on April 30th and the second half on October 31st. Renew Your Vehicle Registrations Online.

The Treasurers Office is responsible for collecting all taxes for the county including. Due Date Extended Due Date. Taxes in South Dakota are due and payable the first of January.

When a filing or payment due date falls on a. The Yankton County Veterans Service office will be closed from Monday May 9 2022 through Friday May 13 2022 for training. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

A service fee will be charged for paying taxes online. Taxation of properties must. 2020 taxes are payable in 2021.

You can see the amount of the service fee in the online form between Payment Amount and Total Amount Contact the Brookings County Finance Office at 605-696-8250 with questions. However the first half of the property tax payments are accepted until April 30th without penalty. Tuesday June 21 2022 Wednesday July 20 2022 Monday August 22 2022 Tuesday September 20 2022 Thursday October 20 2022 Monday November 21 2022 Tuesday December 20 2022 Friday January 20 2023.

The second half of taxes will be accepted until October 31st without penalty. Turner County Property Tax Payments Annual Turner County South Dakota. The states laws must be adhered to in the citys handling of taxation.

22 rows Payments are due the 25th of each month. April 30 - Special Assessments are a current year tax that is due in full on or before this date. 1200 PM 1200 PM Friday May 20 2022.

Real estate tax notices are mailed to the property owners in either late December or early January. 128 of home value. 2020 MILL LEVIES Page 1 Page 2.

Real estate tax notices are mailed to property owners in January. Tax Return Filing Due Date. Reports must be received by the last day of the month following the end of the quarter.

Median Property Taxes No Mortgage 1439. Real Property is Assessed each year by the Director of Equalization verified by the Auditor who then applies the mill levy and billed by the Treasurer who is responsible for collecting the taxes. The second half of your real estate taxes are due by midnight on October 31 st.

The second half of property tax payments will be accepted until October 31 without penalty. The first half of taxes are due by April 30th and the second half are due by October 31stall taxes under 5000 and any special assessments are due in full by April 30th. Median Property Taxes Mortgage 1632.

1200 PM 12. Click here for the latest information on motor vehicle titling and registration. October 31 - Second Half of Real Estate Taxes are due on or before this date unless total tax is under 5000 all taxes under 5000 are due in full by April 30 Vehicle Registration.

The second half of taxes will be accepted until October 31st without penalty. To leave a message for Veterans Service Officer Cody Mangold you can call 605-260-4420. Tax amount varies by county.

605-347-5871 Monday - Friday. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised value and 4 be held taxable unless specially exempted. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as.

Taxes in South Dakota are due and payable the first of January however the first half of property tax payments are accepted until April 30 without penalty. All special assessments are due in full on or before April 30. For questions please call the Meade County Treasurers Office at.

Payment of property taxes is due on the following dates. We assist the disabled and senior citizens to see if they qualify for a tax freeze which. Tax Return Filing Due Date.

Julie Hartmann Turner County Treasurer 400 S Main Box 250 Parker SD 57053 Phone. Taxes in South Dakota are due and payable the first of January. April 30 - First Half of Real Estate Taxes are due on or before this date.

Find information about the South Dakota Commission on Gaming laws regulations and the seven types of gaming licenses issued to the general public. Visit your countys official website or Department of Revenue and make an electronic payment to avoid queuing and waiting. The property tax due dates are April 30 and October 1 for the first and second half instalment respectively.

May 20 May 20. Appropriate communication of any rate hike is also a requisite. However the first half of the property tax payments is accepted until April 30th without penalty.

The first half of your real estate taxes are due by midnight on April 30 th. Information for South Dakota County Treasurers to explain property tax relief programs tax deeds and special assessments.

South Dakota Title Transfer Etags Vehicle Registration Title Services Driven By Technology

North Dakota Sales Tax Rates By City County 2022

Sales Tax Exemption Sd State Auditor

Property Tax South Dakota Department Of Revenue

Pandora Papers Reveal South Dakota S Role As 367bn Tax Haven Us News The Guardian

The Most And Least Tax Friendly Us States

South Dakota Property Tax Calculator Smartasset

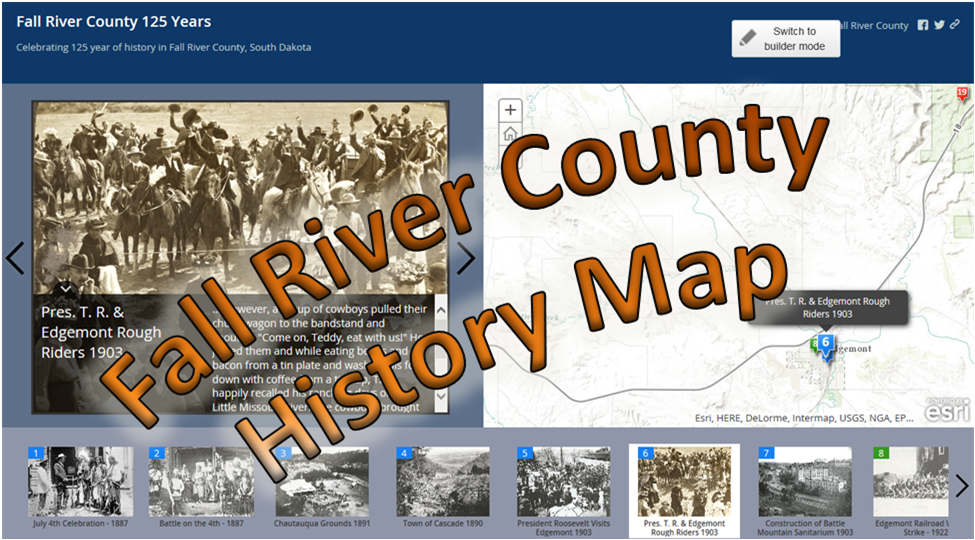

Fall River County South Dakota 906 N River Street Hot Springs Sd 57747

South Dakota Coronavirus Map And Case Count The New York Times

South Dakota Sales Tax Small Business Guide Truic

Sales Use Tax South Dakota Department Of Revenue

Property Tax South Dakota Department Of Revenue

South Dakota And Sd Income State Tax Return Information

Property Tax South Dakota Department Of Revenue

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States

Assessment Freeze For The Elderly Disabled South Dakota Department Of Revenue

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)