kern county property tax payment

Last day to pay unsecured taxes without penalty. Enter only the street name and optional street number.

California Public Records Online Directory

Application for Business Tax Certificate.

. Handled by the Assessors Office Application to Reapply Erroneous Tax Payment. A Notice of Supplemental Assessment relates to a new assessment resulting from a change in ownership or new construction. Do not enter the street.

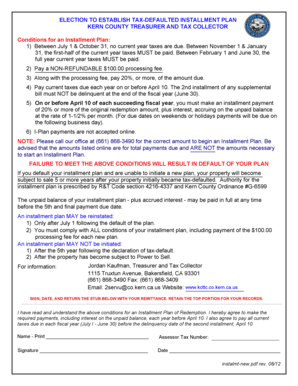

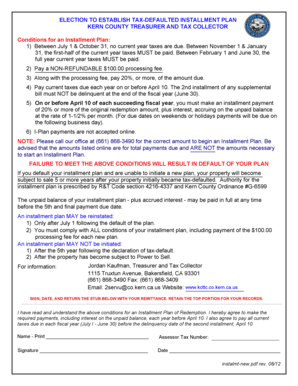

Property Taxes - Pay Online. The first installment is due on 1st November with a payment deadline on 10th December. Look up your property here.

The county does not include a convenince fee in your printed property tax bill. The Treasurer-Tax Collector collects all property taxes. If you have questions regarding your propertys value the Assessor-Recorder can be.

Learn about the 10 Recorder Anti-Fraud Fee attached to the recording of several real estate instruments. Secured tax bills are paid in two installments. Kern County CA Home Menu.

Property Taxes - Pay Online. Senate Bill 813 enacted on July 1 1983 amended the California Revenue and Taxation Code to create what are known as Supplemental Assessments. The owner search is the best way to find a property.

Says 150 of the area median income or AMI requirement here in Kern county. Start by looking up your property or refer to your tax statement. California Mortgage Relief Program Property Tax Assistance Countdown to Deadline.

We are accepting. Application for Tax Penalty Relief. To facilitate your payment and billing for Services facilitate payroll and tax Services for our Customers and detect and prevent fraud.

Child Abuse or Neglect. The penalty of 10 shown on the stub of your bill is not applied until the delinquency date - usually after August 31 at 500 pm. 800 AM - 500 PM Mon-Fri 661-868-3599.

Enter a partial or complete street name with or without a street number. Request For Escape Assessment Installment Plan. The property tax assistance that began on June 13th 2022 provides up to 20000 to cover past-due property taxes.

Enter a 10 or 11 digit ATN number with or without the dashes. Kern County CA Home Menu. Regardless of the method of payment the County of Kern will refund overpayments.

Please enable cookies for this site. Do not include the. Full cash value may be interpreted as market value.

Auditor - Controller - County Clerk. County Clerk Fictitious Names 2221 Kern Street Fresno 559 600-2575. How to Use the Property Search.

Search for your property. The first round of property taxes is due by 5 pm. Establecer un Plan de Pagos.

Application for Tax Relief for Military Personnel. Cookies need to be enabled to alert you of status changes on this website. Last day to request a Proposition 8 decline in value review of the assessment on the current tax.

Use our online tool to check for foreclosure notices and tax liens on a property. The Assessor-Recorder establishes the valuations. More than 70 of all taxes collected is allocated to 120 governing boards of schools cities and special districts.

1115 Truxtun Avenue Bakersfield CA 93301-4639. The Treasurer-Tax Collector collects the taxes for the County all public schools incorporated cities and most other governmental agencies within the County. Kerr County Tax Office.

Enter an 8 or 9 digit APN number with or without the dashes. If you elect to pay by credit card the county needs to recover the Service Fee that will be charged by the credit card company in order to offset the cost of providing the service. This law requires that any increase or decrease in assessed value due to a change in ownership or completed new construction becomes effective beginning with the first day of the month following the.

The Kern County treasurer and tax collector is warning people not to be late otherwise a. Ad Pay Your County of Kern CA Bill Online with doxo. Please select your browser below to view instructions.

Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year. Find Kern County Online Property Taxes Info From 2022. Ad One Simple Search Gets You a Comprehensive Kern County Property Report.

If you are having trouble viewingcompleting the forms you will need to download. A 10 penalty is. Property Taxes - Assistance Programs.

Pin By Bbb Serving Central California On Bbb Accredited Businesses General Contracting Mobile Solutions Fresno County

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

County Tax Collector Sends Final Delinquency Notices Kbak

Loansigning Complete Customers Refinancing Their Loan For A Lower Interest Rate Metropolitanhome Notary Sign Dates Notary Service

Kern County Treasurer And Tax Collector

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

Kern County Property Tax Fill Online Printable Fillable Blank Pdffiller

New Homes For Sale In Rosamond California Your Dream New Home In Rosamond 3 Broker Co Op 3 Exci New Home Builders California Modern New Homes For Sale

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Retirement Planning Spreadsheet Track Investments Spreadsheet Template Budget Spreadsheet

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

New Homes For Sale In The Southern California 3 Broker Co Op And Frontier S Best Deals Brokers Welcome New Homes For Sale New Home Builders New Homes

How To Calculate Property Tax Everything You Need To Know New Venture Escrow